Gold has hit new highs – But is the rally just getting started for miners?

As the gold price approaches USD 2400/oz, precious metals equities face a potentially historic rally

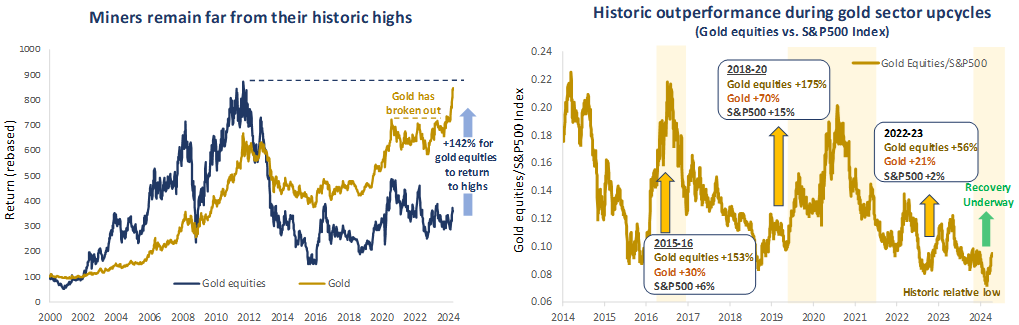

Recent months have seen the gold price move decisively into a higher trading range, and momentum return to the precious metals mining sector following three years of consolidation. Gold has risen c.14% during 2024 so far, while gold miners have recovered c.34% since the sector’s February lows[i]. While encouraging, these returns represent only a fraction of the performance exhibited by gold equities during previous upcycles. The potential catch-up trade for gold equities versus gold is substantial, given the extreme low valuations from which the sector is recovering.

Having touched USD 2400/oz intraday during April, we consider that a cyclical move upwards has begun for the gold sector. Momentum is building as the headwinds for gold and gold miners fade. US interest rate cuts likely lie ahead, despite uncertainty over timing, while gold’s typically inverse relationship with US real interest rates and the US dollar has broken down. In addition, with geopolitical risks rising, most notably in the Middle East, and with an uncertain economic growth outlook, gold is once again proving itself a safe haven asset. Against this bullish backdrop for gold, we believe a period of outsized returns for precious metals miners lies ahead.

The new bull market is just getting started –

- A new structural bull market – Gold has begun a cyclical move upwards, driven by structural demand trends, a macroeconomic shift and historic US debt levels. This has set a floor from which gold can rally when the US Fed cuts rates. Silver is also breaking out, amid a supply deficit and rising demand from solar photovoltaics.

- Robust demand trends – Gold demand is underpinned by central bank buying and Asian demand, yet most western investors remain on the sidelines. Gold has tested USD 2400/oz and the Fed has yet to start cutting rates, suggesting the bull market may have significantly further to run. Geopolitics will likely remain a driver.

- The precious metals equities rally is just getting started – Historically, a major move in gold prices has been followed by significant outperformance by precious metals equities. Gold miners are in strong financial health and are rallying from extreme low valuations. The upside potential at this point appears substantial.

- Wider opportunities across mining equities – The gold sector is one of many commodities, such as copper, offering opportunities at present. Baker Steel has a strong track record of making these calls correctly.

How far can gold equities rise?

Historically, gold equities have tended to deliver 2-5x leverage during gold bull markets, as demonstrated in recent upcycles, notably in 2018-2020 and 2015-2016 (illustrated below). As the new cycle gains pace, we note that gold equities are recovering from extreme lows relative to gold and broad markets, and remain far from their historic highs.

Figure 1

Source: Bloomberg, Baker Steel internal, ICE Benchmark Administration, World Gold Council, Company Filings. Data at 23 April 2024.

Gold equities have suffered a de-rating in recent years, despite relatively strong performance by physical gold. We identify three primary causes of this tepid investor sentiment. First, concerns over cost inflation have been a theme in recent years for the mining sector, as a capital-intensive industry. Secondly, questions over miners’ capital discipline have persisted, following a misallocation of spending during previous cycles. Lastly, a general aversion to non-mainstream equities in recent years among investors appears to have sapped interest in specialist sectors.

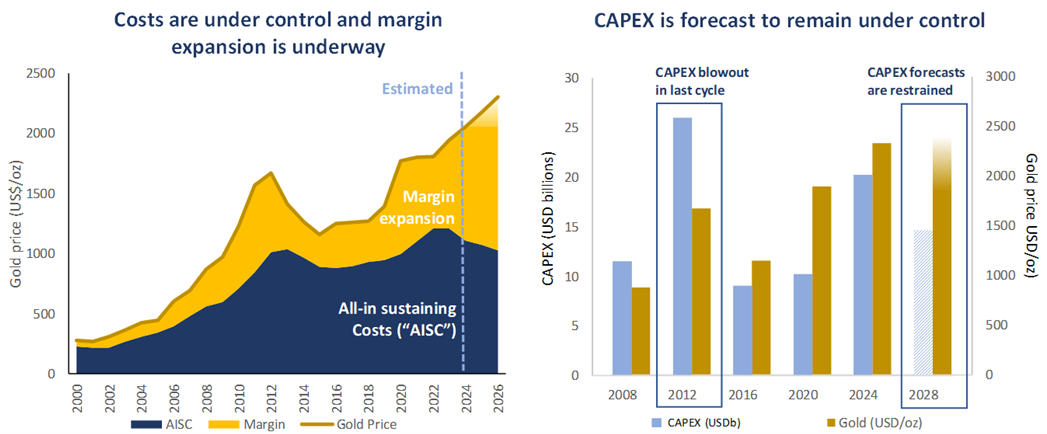

Beginning with cost inflation, we observe that cost increases have not been as severe as could have been the case. The gold sector saw all-in sustaining costs (“AISC”) rise by around 10% p.a. during 2021 and 2022, yet remained flat in 2023, and are expected to decline slightly in 2024[ii]. Early evidence from companies’ Q1 2024 reporting is highlighting that costs are under control. Both Newmont Mining and Agnico Eagle Mines, two gold majors, have beaten expectations in part due to successful cost management[iii].

Figure 2

Source: Company filings, Bloomberg, Baker Steel internal, ScotiaBank, Wood Mackenzie. Note, CAPEX represented by top 20 miners between 2008 and 2024. Note, gold price estimate based on 3% YoY growth.

Importantly, despite rising average gold prices in recent years, many gold miners have seen margins continue to expand. Gold producers maintained a healthy AISC margin estimated at around USD 730/oz in 2023, which is forecast to continue to expand in the years ahead. Today we see that many miners are successfully continuing to demonstrate that costs are under control and margins are expanding. This trend has been reflected in gold producers’ capital allocation discipline, which appears to be holding, as indicated by strong dividend policies and selective M&A activity underway in the gold sector. There is little evidence that the gold sector is falling into the traps of the last cycle, amid continued scrutiny on costs and spending. Indeed, while CAPEX has risen steadily in recent years, forecasts indicate restrained expenditure in the years ahead. One reason for CAPEX expectations to remain tempered is the reality that there are not many Tier 1 gold assets left for development. As a result, M&A is becoming increasingly important for miners to maintain or increase production.

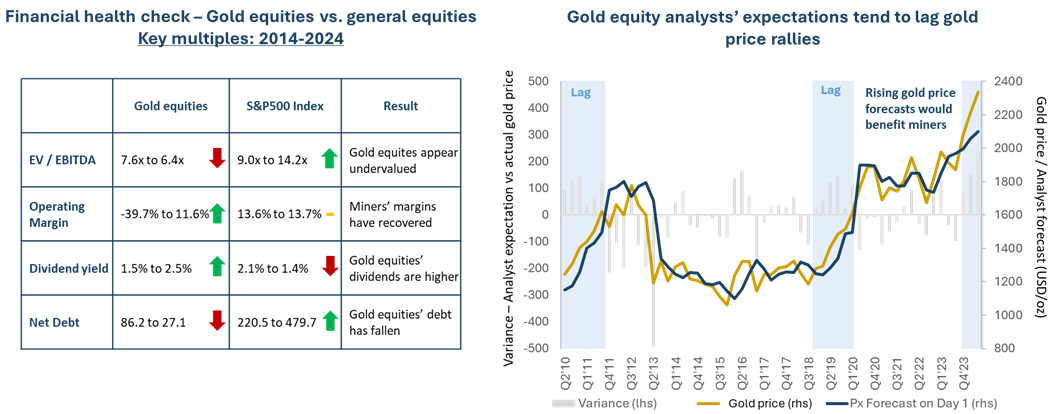

Alongside these industry-specific factors, weak investor sentiment towards precious metals equities reflects a general lack of interest in non-mainstream equities, which has pervaded across many equity sectors, notably across small- and mid-caps equities. In our view this dynamic has created a value opportunity in the sector. As illustrated in the table below, gold equities’ operating margins, yields and debt levels have all improved over the past decade; something which has not been the case in general equity markets[iv]. Operating margins have gone from negative in 2014, which marked the end of a downturn for the sector, to levels comparable to general equity markets. Gold miners’ dividends have increased from 1.5% to 2.5%, while the S&P500 Index has seen yields fall from 2.1% to 1.4%. Net debt has fallen by almost 70% in the gold sector, yet it has more than doubled for the S&P500. Despite these improvements, the valuations of gold equities have dropped, while those for US stocks continue to rise. On an EV/EBITDA basis gold miners dropped from 7.6x to 6.4x over the last decade, while the S&P500 rose from 9.0x to 14.2x[v]. Investors’ focus on the “Magnificent 7” and technology stocks has proved persistent, however history shows that a general rotation away from mega-cap stocks can occur.

Figure 3

Source: Bloomberg, Baker Steel internal. Data at 29 March 2024. Note: gold forecasts are based on quarterly gold price forecasts per Bloomberg vs. actual gold price (LBMA PM fix).

As higher gold prices boost earnings and sector analysts discount higher gold prices, we expect gold and silver producers to outperform the physical metals. As shown on the chart above, gold analysts’ gold price expectations tend to lag the actual gold price during the early stages of a bull market. As momentum builds for gold equities, we anticipate that those miners with expanding margins and strong shareholder returns programmes will deliver outsized returns, highlighting the need for an active approach to stock selection. Overall miners have largely been in strong financial shape in recent years, even before gold prices began to rise meaningfully. As the cycle turns towards recovery, historical precedent suggests that a sustained period of strong performance by precious metals miners may lie ahead.

What is driving the new gold bull market?

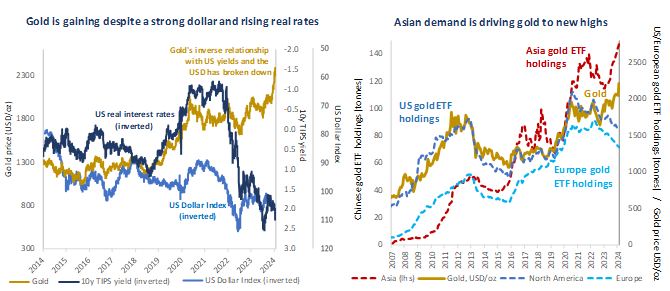

Gold’s recent breakout marks a turning point for the precious metals sector, amid indications that the upcycle is backed by long-term demand trends. The momentum behind gold’s rally is highlighted by the fact that gold has broken from its typical inverse relationship with the US dollar and US real rates. As illustrated in the chart below, the gold price is making a significant upwards move despite resurgent real interest rates (10y TIPS yield) and against the backdrop of US dollar strength.

Figure 4

Source: Bloomberg, Baker Steel internal, ICE Benchmark Administration, World Gold Council, Company Filings. Data at 23 April 2024.

We identify three key buyers for gold at present, each representing a long-term investment trend. Firstly, Asian demand for gold, via ETF/ETCs as well as physical bars, coins and jewellery, is strengthening. Chinese consumer demand for gold has risen +13% year-on-year to 295 tonnes, while Chinese investment demand has risen +68%[vi], as rising economic risk and volatility in the Chinese financial market continues to drive physical gold purchases. Demographic trends and an uncertain economic outlook for China suggest demand for gold is unlikely to fade. Strong Asian gold ETF/ETC demand contrasts with weak western demand for these products, indicating asset managers and retail investors in the US and Europe have largely remained on the sidelines of the new gold bull market so far. There are however signs that this is turning, with US gold ETF/ETC holdings registering a slight increase in March 2024 following heavy outflows during January and February. Furthermore, signs of improving US retail sentiment can be seen in Walmart and Costco’s sales of gold bars, which have proved wildly popular, with stock selling out almost immediately and an estimated USD 100-200m of gold being bought each month by shoppers (the equivalent of 40-80koz of gold, equalling about half as much as Chinese central bank demand)[vii]. Should western investors continue to return to the market, this would represent a highly significant driver for gold prices. Previous gold upcycles in 2016 and 2019-20 demonstrated that a shift in western investor sentiment towards gold, and corresponding pick-up in gold ETF/ETC buying, can be a key driver for the metal.

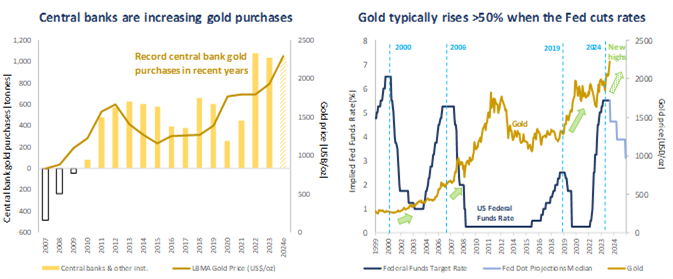

A second driver for gold has been central bank gold purchasing, which is becoming an increasingly influential driver for gold. Central bank buying has exceeded 1000 tonnes for the past two years, representing record levels of gold demand from these institutions. Once again, we believe this represents a long-term driver, against a backdrop of geopolitical confrontation, deglobalisation and a trend towards de-dollarization. Geopolitical events, notably the Russia-Ukraine war and US-China tension over Taiwan, have highlighted the risk some central banks may face from holding US backed assets. This trend has been led by the BRICS economies, which have continued to diversify away from US treasuries. Notably, China appears to have been actively selling, having reduced its US treasury holdings by c.28% since 2020[viii].

Figure 5

Source: Metals Focus, Refinitiv GFMS, World Gold Council, Company Filings. Data at 31 March 2024.

The third notable category of gold buyer at present is institutions active in options and futures markets. Looking at gold futures positioning, total net ‘longs’ having recovered to almost a two year high in early April[ix]. However, based on this measure, bullish sentiment remains far from the highs seen in previous cycles, implying that many Western institutional investors remain on the sidelines. In our view, these indications of a bullish shift towards gold represent recognition of the macroeconomic shift underway as the central banks, led by the US Fed, move closer to interest rate cuts, coupled with growing concern over soaring US debt levels and potentially unsustainable debt servicing costs. Furthermore, while US employment has largely remained stable, the possibility of a stagflationary scenario still exists, amid evidence that supply-side inflation remains sticky. Gold prices have largely weathered the sharp hiking cycle of the past two years and, amid indications that inflation has been materially brought down, the prospect of potential rate cuts is highly beneficial for gold. As illustrated in the chart above, during the past three cycles the gold price rose by over 50% following the commencement of interest rate cuts, in 2000, 2006 and 2019. A similar pattern for the cycle ahead would imply gold prices have significantly further to rise in the years ahead.

With a range of drivers for the new gold bull market, we consider that the outlook for precious metals is stronger than it has been for some time. It appears that from Chinese traders and US shoppers at CostCo, to central bankers and institutional investors, gold’s broad appeal is growing.

What benefits can precious metals equities bring to your portfolio?

Precious metals equities offer two key benefits for investors’ portfolio, effective diversification and operational leverage to rising gold and silver prices. Potential returns can be substantial in this sector, particularly during a gold sector upcycle. Yet, as a speciality equity sector, it can be a challenging space to invest in without technical knowledge.

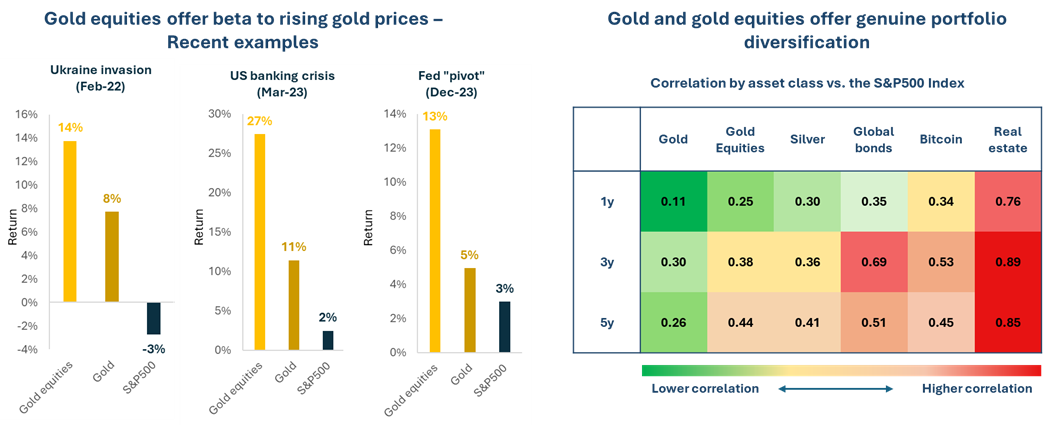

The diversification benefits of an allocation to the precious metals sector are impressive. As illustrated in the table below, while physical gold provides the greatest diversification benefits (exhibiting just a 0.1 correlation with the S&P500 over the past year), gold equities are similarly uncorrelated (0.25 correlation over one year). Even over longer time periods, the correlation between gold investments and US equities remains low. Over 3 years gold and gold equities have just a 0.3 and 0.38 correlation with the S&P500, compared to bonds, real estate and bitcoin which deliver performance significantly closer to the S&P 500 (with correlations of 0.69, 0.89 and 0.53 respectively)[x].

A second key reason to invest in precious metals equities is to achieve beta to rising gold and silver prices. This operational leverage, which occurs as miners achieve margin expansion when precious metals prices rise, results in a substantial outperformance relative to physical gold during rallies. As shown on the chart below, this relationship has held during the recent gold sectors rallies.

Figure 6

Source: Bloomberg. Data as at 29 March 2024. Data in USD terms. Notes, Ukraine invasion covers 24/2/22-8/3/22, US banking crisis covers 8/3/23-5/4/23, Fed “pivot” covers 12/12/23-24/12/23. Gold equities are represented by the GDX.

As in previous cycles, we believe active management will be the key to achieving enhanced returns relative to passive investments in the sector. The performance of Baker Steel’s precious metals equities strategy in recent months demonstrates the value of active management and highlights the importance of exposure to the mid-cap portion of the precious metals sector. Nimble value-risk based stock selection and a focus on fundamental beta remain core elements of our investment strategy, offering substantial upside potential while managing downside. A current example of this is the silver sector, which we believe offers a compelling tactical opportunity for investors. The silver sector has faced a disproportionate sell-off relative to gold equities in recent years, yet historically delivers superior returns relative to gold in a precious metals bull market. We see substantial undervaluation in silver equities, as well as significant upside potential for the silver sector as a whole as rising industrial demand, particularly for solar photovoltaics, and a lack of new production capacity, indicates a meaningful supply deficit for the coming years.

The precious metals sector is not the only area of the metals and mining space which faces a bullish outlook in the months and years ahead. So far, 2024 has seen the copper sector move into a bull market, driven by imminent supply deficits and a supportive longer-term outlook for copper demand for electrification and the green energy transition. Alongside our flagship precious metals strategy, Baker Steel manages an award-winning speciality metals equities strategy (“Electrum Strategy”) which invests in the producers of metals and minerals for a sustainable future. In recent months the Electrum Strategy has been overweight copper equities given the positive outlook we see for this sub-sector, yet our exposure will change over time as the supply and demand dynamics for different metals fluctuate. For instance, while battery metals such as lithium, nickel and cobalt, have been out of favour for much of the past year due to oversupply, there will likely come a point at which it will become appropriate to overweight these critical metals in anticipation of recovery.

With gold and silver having entered a new upcycle and with a supportive near-term outlook for a range of other metals, the upside potential for mining equities appears substantial. Baker Steel’s team remains focused on delivering our unique and value driven investment approach, to the benefit of our clients, while adhering to sector leading ESG practices.

[i] Source: Bloomberg. Gold equities represented by the MSCI ACWI Select Gold Miners Index. Data as at 26 April 2024.

[ii] Source: Baker Steel internal. ScotiaBank, Wood Mackenzie.

[iii] Source: Barrick Gold, Agnico-Eagle Mines, company reports.

[iv] General equities represented by the S&P500 Index.

[v] Source: Bloomberg, Baker Steel internal. Data at 29 March 2024.

[vi] Source: World Gold Council. Data at 31 March 2024.

[vii] Source: Wells Fargo, the Economist.

[viii] Source: Bloomberg. Data at 31 December 2023.

[ix] Source: World Gold Council. Data at 16 April 2024.

About Baker Steel Capital Managers LLP

Baker Steel Capital Managers LLP manages three award winning investment strategies, covering precious metals equities, speciality metals equities and diversified mining.

Baker Steel has a strong track record of outperformance relative to its peers and relative to passive investments in the metals and mining sector. Fund Managers Mark Burridge and David Baker have been awarded two Sauren Gold Medals for 2022 and were awarded Fund Manager of the Year at the 2019 Mines & Money Awards.

Baker Steel’s precious metals equities strategy is a 2023 winner for the sixth year running of the Lipper Fund Awards while Baker Steel Resources Trust has been named Investment Company of the Year 2021, 2020, 2019, Natural Resources, by Investment Week.

Sources: S&P, USGS, Benchmark Mineral Intelligence, Albemarle, Bloomberg, Bloomberg New Energy Finance.

Important

Please Note: This document is a financial promotion is issued by Baker Steel Capital Managers LLP (a limited liability partnership registered in England, No. OC301191 and authorised and regulated by the Financial Conduct Authority) for the information of a limited number of institutional investors (as defined in the Fund prospectus) on a confidential basis solely for the use of the person to whom it has been addressed. This document does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or purchase any shares or any other interests nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefor. Recipients of this document who intend to apply for shares or interests in Baker Steel’s funds are reminded that any such application may be made solely on the basis of the information and opinions contained in the relevant prospectus or other offering document relating thereto, which may be different from the information and opinions contained in this document. This report may not be reproduced or provided to any other person and any other person should not rely upon the contents. The distribution of this information does not constitute or form part of any offer to participate in any investment. This report does not purport to give investment advice in any way. Past performance should not be relied upon as an indication of future performance. Future performance may be materially worse than past performance and may cause substantial or total loss.