Silver and platinum group metals – Time to shine?

The mining sector is riding the silver and platinum rally

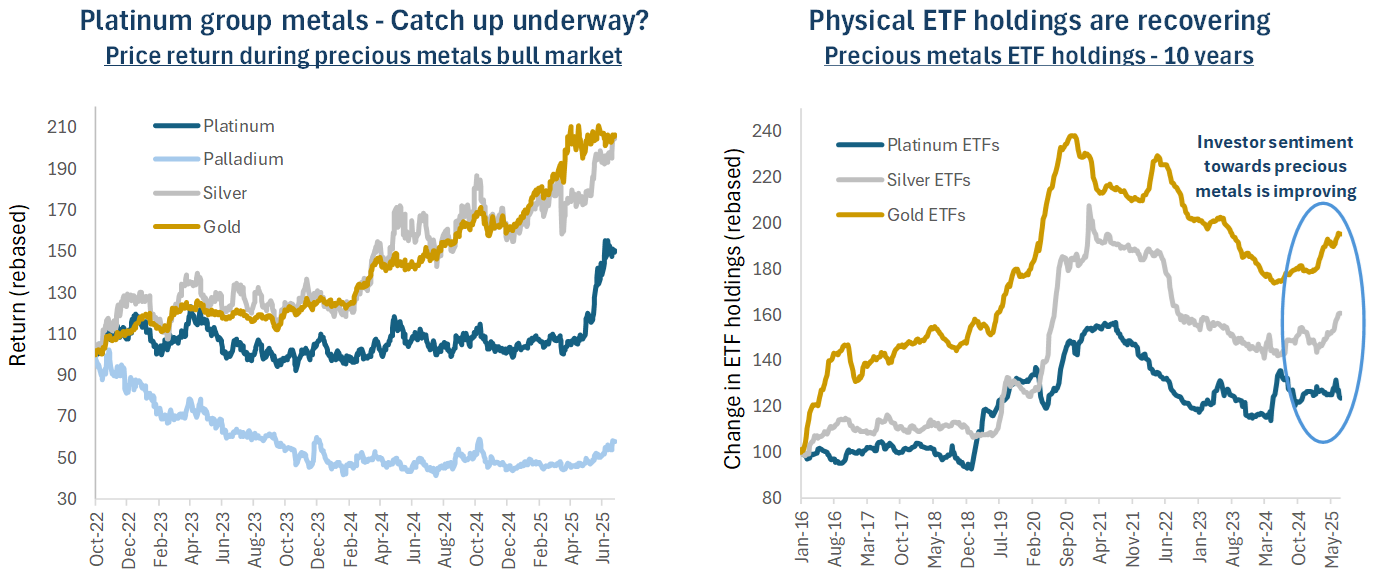

Gold has led the new bull market for precious metals in recent years, yet investor attention is increasingly turning towards silver, platinum group metals (“PGM”), and the miners which produce these precious metals. This is because, historically, pronounced upward moves in the gold price have preceded strong performance across the broader precious metals complex, driven by their shared roles as safe haven assets and portfolio diversifiers.

Silver and platinum are now benefitting from a dual tailwind of industrial demand and signs of a nascent recovery of investor interest. Silver demand from solar photovoltaics (“PV”), electronics, and AI technologies, and platinum demand from automotive catalysts and the potential hydrogen economy, highlight the strategic role of these critical metals for the New Industrial Revolution. At the same time, flows into physical ETFs appear to have reached a turning point, while mining equities are experiencing a rebound in performance.

Crucially, both silver and platinum remain in structural supply deficits and prices remain far below historic highs. This tight fundamental backdrop, combined with growing demand and rising investor conviction, present a bullish case for higher prices and a potential re-rating of undervalued silver and PGM miners. As active managers, Baker Steel seeks opportunities across the wider mining sector, focussing on undervalued miners facing positive growth trends.

Amid a new bull market for precious metals, silver and PGMs are set to shine –

- Silver – The silver squeeze is underway

Industrial demand from solar, electronics, and AI continue to underpin silver’s fundamentals. A resurgence in investment demand could catalyse a rally toward all-time highs, before potentially setting new highs.

- PGMs – Platinum leads the way

Platinum is in its strongest bull run in over a decade, supported by robust industrial demand and persistent supply tightness. Platinum’s outlook is increasingly bullish amid signs of improved investor interest.

- Precious metals mining equities – Significant re-rating potential

Miners remain attractively valued despite recent strong performance. With strong balance sheets and growing margins, silver and PGM producers, alongside gold miners, are poised to benefit from the next leg of the cycle.

Figure 1

Source: Bloomberg, Baker Steel Capital Managers LLP. Data at 15 July 2025.

Silver squeeze – Time for a breakout?

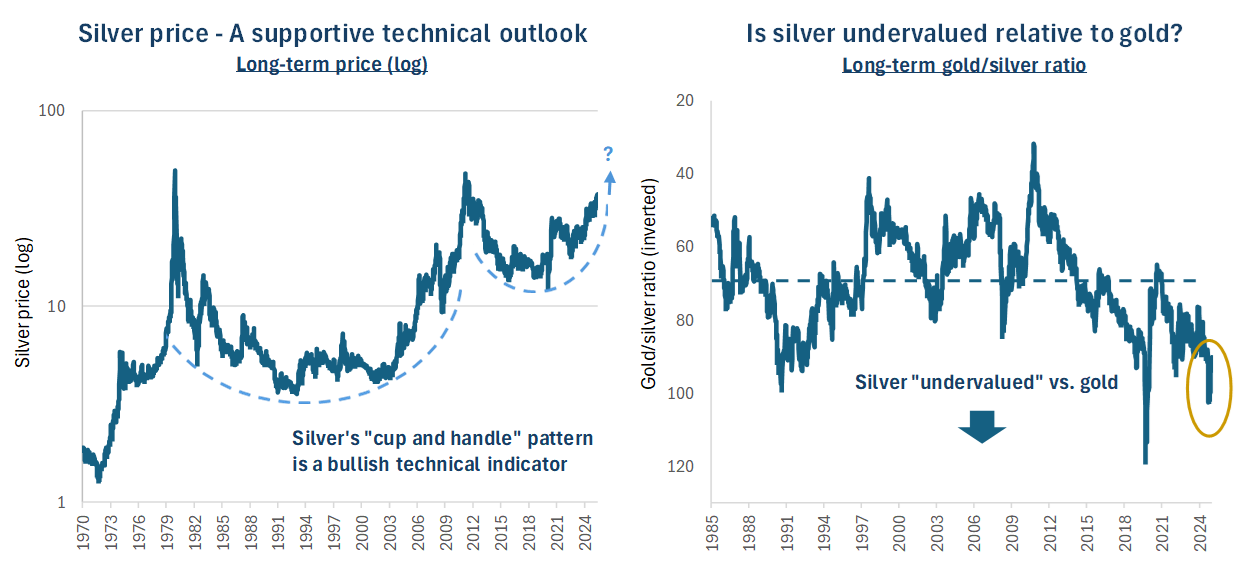

Silver typically tracks the direction of gold but with higher volatility, often outperforming in the latter stages of a precious metals bull market, with industrial demand a key price setter. Historically, gold has led rallies, with silver catching up, and frequently overtaking, as momentum builds. Silver has rallied to new recent highs of c.USD 39/oz in recent days, however the gold-silver ratio (chart below) illustrates just how stretched silver’s valuation relative to gold has become, having now reached 90, far from its long-term average of 60. Given current gold prices of c.USD 3300/oz, a simple return to longer-term average valuation would imply a silver price of around USD 55/oz, or a 45% increase[i], indicating substantial upside potential for the metal even before secular demand trends for silver are considered. Likewise silver miners offer substantial re-rating potential, relative to the broader gold mining sector, particularly during periods of outperformance by silver. With a supportive technical outlook for silver prices and positive supply and demand dynamics, we believe we are entering a favourable period for silver miners to deliver strong performance.

Figure 2

Source: Bloomberg. Data at 11 July 2025.

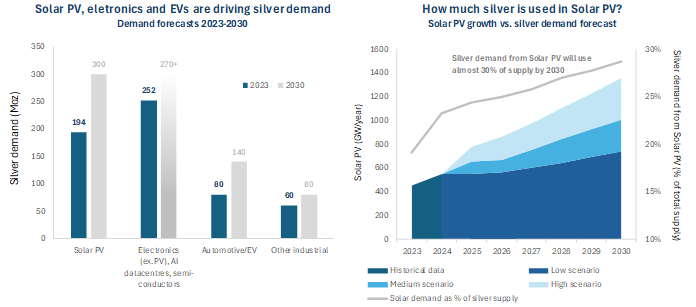

Silver’s dual role as both an industrial and precious metal underpins its unique appeal. In 2024, industrial uses accounted for approximately 58% of total silver demand[ii]. Among these, solar PV and electronics are key drivers. Since 2016, silver demand from the solar sector has surged by 139%, with electronics-related demand up by over 50%[iii]. Looking ahead, silver demand from solar PV alone is forecast to reach nearly 30% of annual supply by 2030, rising from around 23% in 2024[iv]. Despite this powerful structural demand trend, silver’s technological relevance is often underappreciated, making it, in our view, the “unsung hero” of the new industrial revolution.

Figure 3

Source: Silver Institute, Sprott, BloombergNEF, Baker Steel Capital Managers LLP. Note, 2030 estimates based on known technology trends (solar cell architecture, EV drivetrain expansion), CAGR assumptions (PV ~6–8%, EV ~10%, electronics ~2%).

It is worth noting that while industrial buyers provide a strong foundation of demand, they tend to act defensively and are sensitive to policy shift, such as tariffs, seeking clarity before committing to large-scale procurement. This creates a dynamic where industrial demand steadily supports prices, while investment flows can amplify upside when sentiment shifts.

Turning to investment demand, after a period of subdued investor interest silver is showing signs of renewed momentum. As a precious metal, silver shares many of the same macroeconomic drivers as gold, including its role as a store of value and a hedge against inflation, currency debasement, and geopolitical uncertainty. While silver has not benefitted from central bank purchases like gold has in recent years, it carries a similarly deep historical monetary legacy, having served as a foundational currency in many ancient and modern economies. Its greater geological abundance makes it more affordable and accessible to a broader base of retail investors, particularly in periods of rising inflation expectations or declining real interest rates. With the gold price pushing into new territory, silver’s investment appeal is being reassessed, while its historical tendency to outperform gold in later stages of a bull market adds further weight to the bullish case.

Silver ETFs recorded net inflows of 95moz in the first half of 2025, supporting the recent rise in the silver price[v]. Total ETF holdings have been recovering towards their 2021 peak, suggesting encouraging levels of investor re-engagement[vi]. Retail investment trends have been mixed. Indian demand rose 7% year-on-year, reflecting growing interest in physical silver as an accessible store of value. In contrast, retail investment in the US has yet to return, highlighting that sentiment in Western markets has yet to fully turn positive[vii]. Together, these trends suggest early signs of recovery in investor sentiment towards silver, while indicating that broader investor participation has significant upside potential in the current cycle.

Figure 4

Source: Bloomberg, Metals Focus, Silver Institute. Note, 2025 market balance is forecast. Data at 11 July 2025.

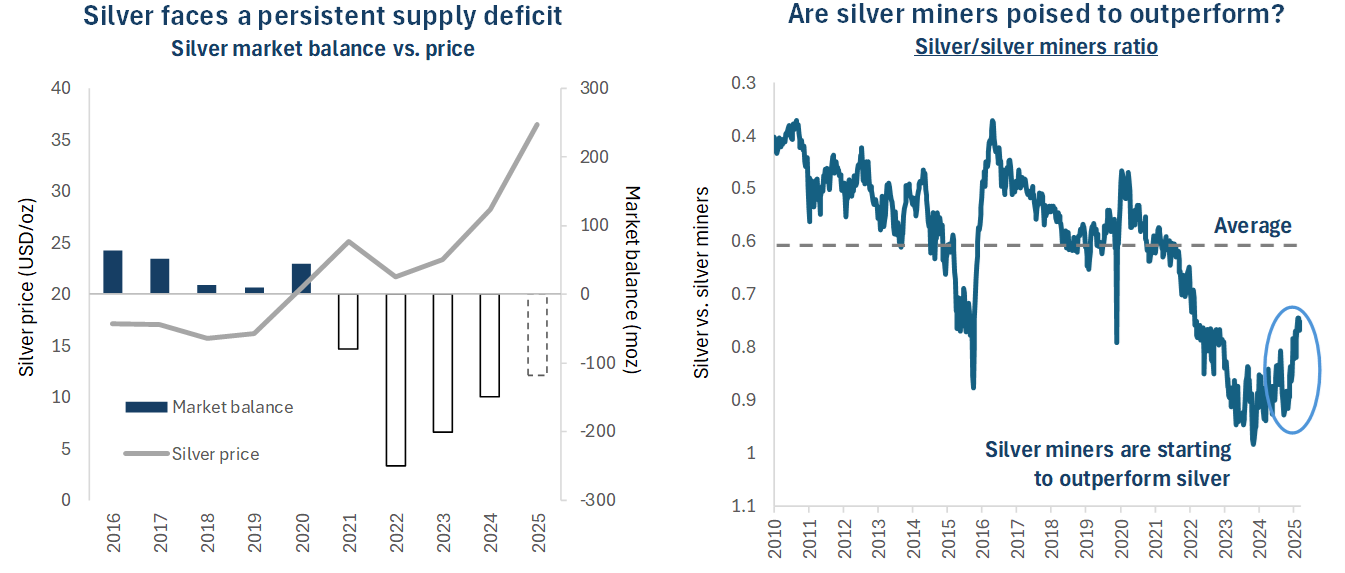

Silver demand continues to outpace supply, making 2025 the fifth consecutive year of the silver market being in a supply deficit, following a 149Moz deficit in 2024[viii]. Mine supply of silver remains tight, with a limited pipeline of primary silver projects, a discovery rate which has lagged depletion for many years, and also due to silver’s by-product status. Only around 30% of silver supply comes from primary silver mines, with the majority mined alongside gold, lead, zinc and copper, limiting the industry’s ability to respond to higher prices with dedicated capex[ix]. Global silver production is expected to marginally increase by 1.9% to 835.0Moz in 2025[x].

A structural deficit such as this tends to increase the chance of price spikes, so it is perhaps surprising that the silver price has not risen faster. Secondary supply has filled the gap, with the silver deficit being met through a run-down of silver inventories. Since 2021, inventory levels at the Shanghai Futures Exchange, the London Bullion Market Association and COMEX have declined dramatically. There has been a cumulative stock rundown of 678Moz in four years[xi], which raises the question of how much longer secondary supply can plug the deficit?

Against this backdrop, the bullish case for silver miners is clear. Margins are expanding as silver prices rise, and costs remain constrained. Silver miners’ costs fell during 2024, with total cash costs down 13% and all-in sustaining cost (“AISC”) down 15% helped by by-product credits[xii]. Silver producer hedging has hit a multi-decade low, while streaming and royalty contracts rose 5% during 2024[xiii]. M&A activity has increased in the silver sector, reflecting companies’ growing interest in securing production assets. June 2025 saw Pan American Silver announce its intention to acquire Mag Silver in a c.USD 2.1B deal. This follows other significant deals announced over the past year, including Coeur Mining’s c.USD 1.7B acquisition of SilverCrest Metals in October 2024, First Majestic Silver’s c.USD 970M acquisition of Gatos Silver, alongside numerous smaller deals. These transactions reflect a strategic shift toward scale consolidation, to benefit from production synergies, as well as strong price-driven confidence, supported by improving investor sentiment towards the sector.

Platinum – Renewed momentum offers recovery potential for miners

Platinum, the best-known of the PGMs, surged to an 11-year high in June 2025, marking a sharp reversal after a prolonged period of weakness across the PGM complex, with also includes palladium, rhodium, ruthenium, osmium and iridium amongst others. This move follows years of price pressure driven by ample above-ground inventories, a mixed industrial demand outlook, and the normalisation of supply chains after COVID-era disruptions.

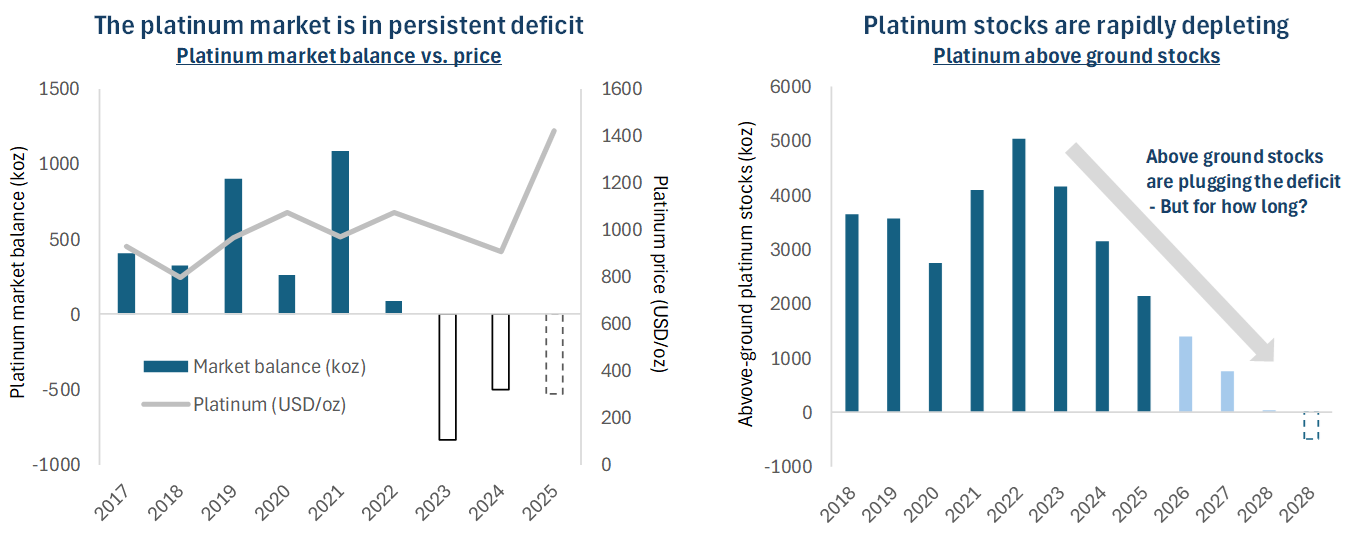

The recent rally reflects a nascent recovery in demand from industrial, jewellery, and investment sectors. Importantly, this demand is emerging against the backdrop of a multi-year structural supply deficit and the progressive drawdown of above-ground stockpiles, as shown on the charts below. While investor interest in PGMs has remained subdued in recent years, platinum’s tightening market fundamentals are now beginning to attract renewed attention.

Figure 5

Sources: World Platinum Investment Council, Metals Focus (2018 – 2025f), 2026-2028 forecasts based on WPIC research.

Automotive usage of platinum accounts for around 33%, primarily for catalytic converter manufacturing[xiv]. While electric vehicle (“EV”) adoption continues, internal combustion engine (“ICE”) vehicles, especially diesel-heavy markets, still rely on platinum for catalytic converters. Substitution between platinum and palladium in catalytic converters is a major driver of pricing between these two PGMs. Over the past three years automakers have increased platinum loadings in catalytic converters to offset palladium costs, sending palladium prices tumbling while supporting platinum. European vehicle production rebounded in H1 2025, boosting platinum demand[xv]. Furthermore, a ramp-up in plug-in hybrid (“PHEV”) production in early 2025 has supported platinum prices, amid a resurgence in demand for PHEVs as a pragmatic midpoint for many consumers between internal combustion and full electrification.

Platinum benefits from broader industrial demand, accounting for around 23% of total demand, with applications across chemicals, refining and manufacturing, and medical sectors[xvi]. A key emerging driver for platinum, and other PGMs, demand is the nascent hydrogen economy, notably where platinum is used in fuel cells. While the hydrogen economy is estimated to account for under 2% of platinum demand in 2025, it is estimated that this could rise fivefold by 2030[xvii]. An increase in hydrogen project announcements in Europe and Asia, have recently supported investor sentiment.

Platinum jewellery demand, which accounts for approximately 23% of total demand[xviii], has been mixed in 2025, with signs of renewed interest in platinum as a luxury alternative to gold. While demand has faced a structural decline in China in recent years, the World Platinum Council reports a boom in new platinum showroom openings in Shuibei, a major gold and jewellery hub, during 2025. This expansion is reportedly being matched by rising platinum fabrication capacity to meet growing local demand, indicating this recovery may be sustained[xix].

Investment demand, encompassing ETFs, bars, and coins, has been subdued in recent years and currently accounts for approximately 20% of total platinum demand[xx]. Following a sustained period of outflows, ETF holdings have stabilised in 2025, with early signs of a recovery in investor interest, supported by a broader rotation into hard assets. A sustained return of investment demand, particularly if supported by stronger price performance, could serve as a key catalyst for renewed upward momentum in the platinum market.

Cautious optimism around platinum demand is set against a backdrop of tight supply conditions. Platinum production is highly concentrated, with approximately 70% sourced from South Africa, a region prone to intermittent disruptions from power shortages and rising cost pressures. These factors have tightened the physical market and provided price support in early 2025, alongside concern from US investors regarding the potential imposition of tariffs on PGMs. For miners, higher platinum prices have improved margins, although producers continue to focus on cost reduction strategies amid an uncertain operating environment. It is worth noting that platinum’s recent strength contrasts with palladium, which remains in structural surplus. Despite the strong price performance year-to-date, the share prices of major PGM producers, including Valterra Platinum, Impala Platinum, and Sibanye-Stillwater, remain 50–60% below their 2021–2022 highs[xxi].

Active management – Unearthing value through stock selection and tactical asset allocation

The silver and platinum fundamentals, highlight the compelling opportunities available to investors in the mining sector, supported by persistent multi-year supply deficits, robust industrial demand, and improving investor sentiment. At Baker Steel, we have recently maintained a overweight position in both silver and PGM producers, reflecting our conviction in their upside potential. We see compelling opportunities among high-quality silver and PGM producers with healthy margins and strong leverage to rising prices.

Despite supportive long-term demand trends, mining equities have experienced a broad de-rating relative to general equity markets in recent years. This disconnect presents a compelling value opportunity for investors looking to capitalise on structural themes such as the clean energy transition, the new industrial revolution, and the rising importance of precious metals in the global financial system, particularly gold, now the second-largest reserve asset after the US dollar[xxii].

The sector’s undervaluation largely reflects limited interest from Western investors, who remain focused on mainstream equities. As a result, many have missed the early stages of the current bull market in metals and mining, led by strong performance in the precious metals segment. While concerns persist around costs and capital discipline, recent company results have shown encouraging trends, including tighter cost control, margin expansion and, in the case of precious metals miners, increased share buybacks. With metal prices holding firm or rising, we believe a re-rating is likely as company performance continues to strengthen. Notably, it would take only a modest rotation out of mainstream equities to generate significant capital flows into the sector.

A supportive macroeconomic backdrop further strengthens the investment case for mining equities, particularly precious metals producers. Potential interest rate cuts by major central banks in the coming months are expected to benefit the sector, as lower rates have historically supported precious metals prices. US monetary policy remains especially important for gold. Recent market reactions to Trump’s criticism of Fed Chair Jerome Powell, and his clear preference for lower interest rates, highlight the sensitivity of gold to US rate expectations. Inflationary pressures also continue to underpin demand for precious metals, including silver. Trump’s proposed “One Big Beautiful Bill” is expected to increase fiscal deficits and public debt, adding to concerns about the stability of the US financial system. In this environment, we believe the safe-haven appeal of precious metals will remain strong.

We believe active management in the mining equity sector offers the potential for superior returns while effectively managing risk. Success in this space requires careful differentiation between companies based on fundamentals, such as asset quality, operational performance and risk exposure, alongside top-down considerations including commodity-specific trends and geopolitical dynamics. At Baker Steel Capital Managers LLP, our active investment approach has a proven track record of delivering enhanced returns in the metals and mining sector. While market volatility is likely to persist, we believe our strategies are well-positioned to capitalise on the opportunities we see. Through active management and nimble asset allocation, our funds are equipped to navigate periods of uncertainty, manage risk, and offer enhanced upside potential relative to a passive holding in precious metals.

[i] Baker Steel Capital Managers LLP, Bloomberg. Data at 15 July 2025.

[ii] Silver Institute, World Silver Survey 2025.

[iii] Silver Institute, World Silver Survey 2025.

[iv] IEA, Energy Institute, The Economist, BNEF, Baker Steel internal forecasts.

[v] Silver Institute, data as of 30 June 2025.

[vi] Metals Focus, Global Silver Investment Escalates in 2025.

[vii] Silver Institute, data as of 30 June 2025.

[viii] Silver Institute.

[ix] World Platinum Investment Council – Platinum Quarterly Q1 2025 Presentation.

[x]S&P, June 2025 Light Vehicle Production Forecast.

[xi] World Platinum Investment Council – Platinum Quarterly Q1 2025 Presentation.

[xii] CME Group.

[xiii] World Platinum Investment Council – Platinum Quarterly Q1 2025 Presentation.

[xiv] World Platinum Investment Council – Platinum Quarterly Q1 2025 Presentation.

[xv] World Platinum Investment Council – Platinum Quarterly Q1 2025 Presentation.

[xvi] Bloomberg, USD, data as of 15 June 2025.

[xvii] Financial Times.

[xviii] Sprott.

[xix] Metals Focus.

[xx]Metals Focus Presentation on World Silver Survey 2025.

[xxi] Source: Metals Focus Silver Mine Cost Service. Note, costs based on a by-product accounting basis.

[xxii] Metals Focus, Silver Institute.

About Baker Steel Capital Managers LLP

Baker Steel Capital Managers LLP manages three award winning investment strategies, covering precious metals equities, speciality metals equities and diversified mining.

Baker Steel has a strong track record of outperformance relative to its peers and relative to passive investments in the metals and mining sector. Fund Managers Mark Burridge and David Baker have been awarded two Sauren Gold Medals for 2022 and were awarded Fund Manager of the Year at the 2019 Mines & Money Awards.

Baker Steel’s precious metals equities strategy is a 2023 winner for the sixth year running of the Lipper Fund Awards while Baker Steel Resources Trust has been named Investment Company of the Year 2021, 2020, 2019, Natural Resources, by Investment Week.

Sources: S&P, USGS, Benchmark Mineral Intelligence, Albemarle, Bloomberg, Bloomberg New Energy Finance.

Important

Please Note: This document is a financial promotion is issued by Baker Steel Capital Managers LLP (a limited liability partnership registered in England, No. OC301191 and authorised and regulated by the Financial Conduct Authority) for the information of a limited number of institutional investors (as defined in the Fund prospectus) on a confidential basis solely for the use of the person to whom it has been addressed. This document does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or purchase any shares or any other interests nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefor. Recipients of this document who intend to apply for shares or interests in Baker Steel’s funds are reminded that any such application may be made solely on the basis of the information and opinions contained in the relevant prospectus or other offering document relating thereto, which may be different from the information and opinions contained in this document. This report may not be reproduced or provided to any other person and any other person should not rely upon the contents. The distribution of this information does not constitute or form part of any offer to participate in any investment. This report does not purport to give investment advice in any way. Past performance should not be relied upon as an indication of future performance. Future performance may be materially worse than past performance and may cause substantial or total loss.