Outlook 2026: Miners in the spotlight – Are we at the start of a multi-year upcycle for commodities?

Commodities will be more important than ever in 2026 amid growing demand, structurally tight supply, and with increased strategic and geopolitical focus on critical raw materials.

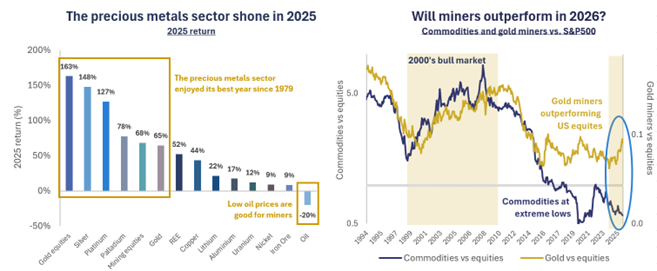

The mining sector enters 2026 with promise, supported by strong tailwinds for both industrial and investment demand alongside constrained supply across many metals. Gold and silver were standout performers in 2025, with precious metals miners emerging as one of the best-performing asset classes globally. A broad range of commodities also delivered robust returns, from copper to uranium and rare earths elements (“REE”) producers supported by structural supply constraints and strategic industrial demand. As an active manager, Baker Steel’s strategies outperformed during 2025, and we believe selectivity will prove increasingly important as the precious metals bull market enters its next phase, M&A activity increases, and as industrial and speciality metals miners face tightening market dynamics and supportive macroeconomic and geopolitical conditions.

Miners currently sit at the centre of three key global investment themes: 1) the New Industrial Revolution, 2) geopolitical and industrial strategy, and 3) shifting macroeconomic conditions. Governments now view metals not just as commodities, but as strategic inputs essential to energy security, defence, electrification and industrial competitiveness. Alongside this, precious metals have re-enforced their role as safe-haven assets for investors and, in the case of gold, as a reserve asset for governments. This report examines investment opportunities across precious, industrial and speciality metals equities in 2026, amid a favourable economic backdrop for Baker Steel’s active strategies.

How far can miners rise in 2026?

- Miners remain undervalued and under owned, trading on relatively low multiples despite strong recent performance and robust balance sheets.

- Structural tightness across key metals is underpinned by industrial renaissance, investment demand and constrained supply.

- Government support and involvement is accelerating, with project financing and offtake agreements for critical minerals highlighting the strategic premium being placed on secure, diversified supply chains.

- The mining sector is ripe for active management, with disparities in asset quality, production growth, value and capital discipline, creating a favourable environment for Baker Steel’s actively managed strategies.

Figure 1

Source: Bloomberg, Baker Steel Capital Managers LLP. Data in USD terms, as at 31 December 2025. Note, gold equities represented by the MSCI ACWI Select Gold Miners Index, mining equities represented by the MSCI ACWI Metals and Mining Index.

Precious metals miners: The next phase of the bull market favours active managers

- The investment case for gold has strengthened – Robust demand, limited supply, supportive macroeconomic conditions, fiscal dominance and volatile geopolitics are all driving gold prices.

- Precious metals miners remain undervalued – Miners’ valuations are low on a relative and historical basis, yet the sector is in strong shape with many companies offering margin expansion, discipline and growth.

- Silver and platinum group metals miners (“PGMs”) – Silver and platinum are in a supply deficit and face strong industrial demand trends. Silver demand for solar photovoltaics is a particularly notable driver.

Gold miners – More to come as profitability increases and discipline holds

As we enter 2026, the outlook for gold mining equities is highly constructive, underpinned by expanding margins, rising profitability, and robust structural support for the gold price. Following a strong performance in 2025, which saw the gold price rise +64.6% and gold miners rise +163.0%[i], producers are entering the new year with strengthened balance sheets, healthy free cash flow generation, and increasingly disciplined, shareholder-friendly capital allocation strategies. The ascent of the gold price over the past year has been a key catalyst for the re-rating of gold mining equities. The physical gold market continues to be supported by a favourable macroeconomic backdrop, as fiscal dominance drives a lower outlook for real yields. The deterioration of the US fiscal position is boosting gold’s appeal, amid an expanding federal debt burden and persistent inflationary pressures. Expectations of further rate cuts in 2026, coupled with unprecedented pressure on the US Federal Reserve by President Trump, are supportive of both gold and silver prices.

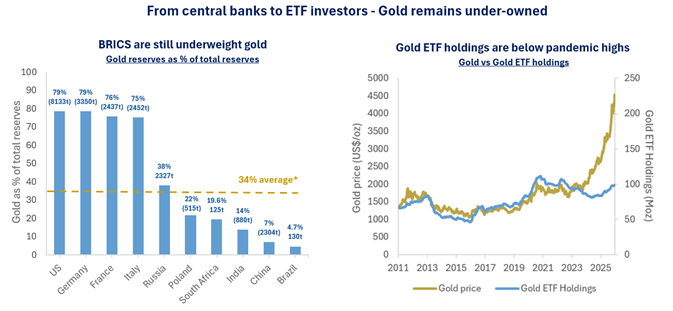

Demand for gold remains broad-based, spanning individuals, family offices, institutional investors, and central banks, with ongoing central bank accumulation providing a particularly strong underpinning to the market. These buyers appear set to continue accumulating gold into 2026 and beyond. With regard to central bank official gold holdings, the trend is clear, as gold continues to restore its role as a reserve asset. Over the past five years, gold has increased by 15% as a percentage of global foreign reserves, while US dollar holdings have declined by -3%[ii]. Central bank buyers of gold are varied, with Poland, Brazil, Kazakhstan and Turkey among the largest buyers in 2025[iii]. Importantly, as shown on the chart below, major central banks including China and India will need to accumulate significantly more gold to reach the 34% average gold holding seen across advanced economies[iv]. Regarding broader investment demand for gold, as shown on the chart below physical gold ETF holdings remain below their pandemic highs, despite strong recent inflows, and account for just 0.17% of private portfolios[v], highlighting that despite strong sector performance, gold itself remains meaningfully under-owned.

Figure 2

Source: Bloomberg, Scotiabank. Data at 29 December 2025. *Note, advanced economy average.

New investor groups are also entering the gold market. Cryptocurrency firms have increased exposure, as demonstrated by Tether’s gold purchases during 2025, bringing its total holding to around 116 tonnes at the end of Q3 2025[i], for its stablecoins. In China, certain regulated institutions can now buy gold under a pilot scheme, while for banks globally the Basel III regulations have increased the attractiveness of holding physical gold as a Tier 1 asset. We see a broadening range of investors across mainstream bond, equity, and alternative asset classes, who will continue to increase exposure to gold. This reflects a growing recognition of the unsustainability of many developed countries’ fiscal positions, the associated macroeconomic and geopolitical risks, and the benefits of holding real assets, most notably precious metals. For this reason, we see gold continuing to move higher in 2026.

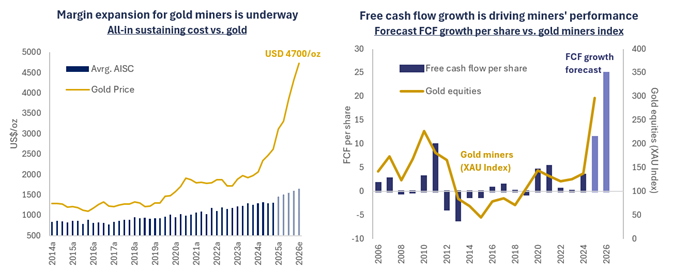

As the gold price rises, gold miners are benefiting from meaningful margin expansion. With current all-in sustaining costs at c.USD 1800/oz[ii] and the gold price comfortably over USD 4000/oz, many miners are generating strong free cash flow. Margin expansion drove gold miners’ strong performance in 2025 and we expect this to continue in 2026, albeit with a wider dispersion of performance, favouring active stock selectors. We see a strong link between margin expansion and share price performance and consider that those companies able to grow and sustain margins, while controlling costs and maintaining capital discipline will be best placed for outperformance.

On the cost side, technological innovation, continuous improvement, and lower energy costs have benefitted miners’ margins. At the same time, capital discipline has largely been preserved. Rather than lowering cut-off grades or pursuing marginal ounces, many producers are prioritising brownfield expansions and a disciplined approach to capital returns. This encouraging behaviour contrasts with the last major gold bull market in the 2000s, during which miners lost discipline to the detriment of shareholders. Dividends have become increasingly attractive as cash flows have strengthened, while share buyback programmes are being implemented, reflecting our view that the sector remains undervalued.

Figure 3

Source: Bloomberg, Baker Steel Capital Managers LLP. Data at 31 December 2025.

Despite miners’ financial strength, the supply side response to higher gold prices has been limited, with the sector facing structural challenges in terms of production growth and grade. While exploration and development spending across the gold sector rose c.4.5% in 2025 and is expected to rise c.3.5% in 2026[i], production growth remains a challenge for much of the sector. Reserve grades have halved since 1990, to just 1.28g/t[ii]. As active managers we remain focused on those companies best positioned to grow and protect their margins while delivering production growth.

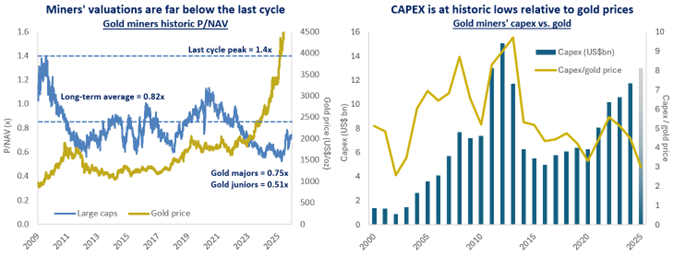

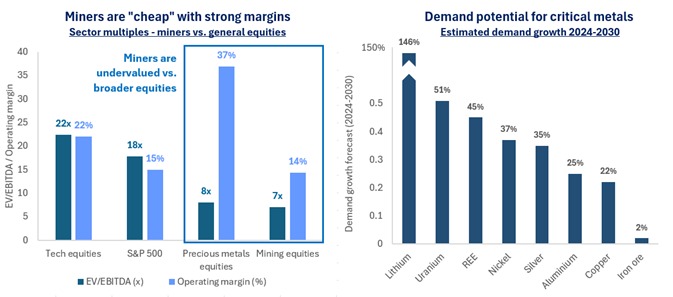

In terms of valuation multiples, precious metals miners remain attractively valued relative to broader equity markets, despite recent strong performance by the sector. Gold producers are currently trading at around 8x EV/EBITDA multiples, well below other equity sectors such as technology at over 22x or US equities on around 18x[iii]. On a P/NAV basis, major gold miners are currently trading at 0.75x, well below their long-term average and far below the valuations reached in the last cycle. Further value can be found in the mid-cap and junior portion of the sector, which currently trades at just 0.51x[iv] (Scotiabank). As illustrated in the chart below, we see substantial scope for further recovery and this valuation disconnect reinforces our view that gold equities remain undervalued relative to their strong financial position. Alongside these valuation indicators, the CAPEX cycle also implies that precious metals miners have substantially further to run, with CAPEX currently at extreme lows relative to the gold price.

Figure 4

Source: Scotiabank, Bloomberg. Data at 31 December 2025.

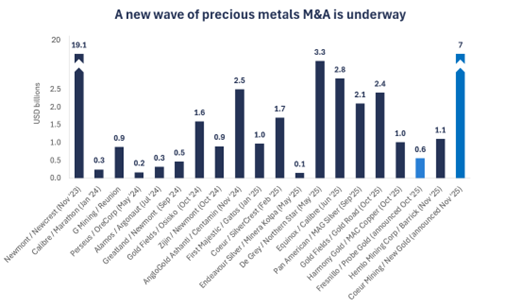

Undervaluation across the precious metals sector, coupled with strong cash flow generation and de-risked balance sheets, have created a dynamic environment for M&A activity. Some notable deals were seen in 2025 among the large-cap miners, including Gold Fields’ c.USD 2.4 billion acquisition of Gold Road Resources, and Northern Star Resources’ c.USD 3.3 billion acquisition of De Grey Mining. Dealmaking among the mid-caps included Equinox Gold’s USD 2.8 billion acquisition of Calibre Mining, building scale and diversification. Furthermore, the silver sector experienced a wave of consolidation over the past year, from the completion of Coeur Mining’s USD 1.7 billion acquisition of SilverCrest Metals to Pan American Silver’s USD 2.1 billion takeover of MAG Silver. As discussed in the next section, we believe the re-rating of the silver sector has begun.

Figure 5

Source: Bloomberg, Company Reports.

Looking ahead, precious metals miners enter 2026 operating in a particularly favourable environment. Robust margins, attractive valuations, active M&A dynamics, and disciplined capital allocation position gold mining equities for sustained investor interest in the year ahead. As producers continue to prioritise free cash flow generation alongside dividends and share buybacks, we expect investor engagement with the sector to deepen. While macroeconomic uncertainty and commodity price volatility may persist, the sector’s strong underlying fundamentals provide a compelling backdrop for potential continued outperformance relative to broader equity markets.

Silver and PGM miners – Robust industrial demand meets rising investor interest

A key investment call by Baker Steel in 2025 was to retain our overweight position in silver miners, as well as to increase weightings to PGM miners, across our strategies. Both silver and PGMs delivered strong performance over the course of the year, hitting record price levels amid a combination of industrial demand growth, investment flows, supply constraints and macroeconomic drivers. We maintain our bullish outlook for these metals going into 2026.

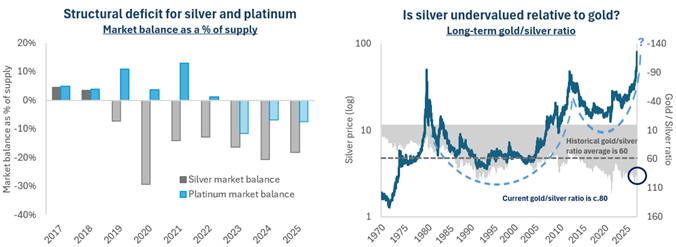

With regard to silver, the metal’s rise to around USD 80/oz in December 2025 marked one of its strongest annual performances on record[i], and strong performance in 2026 so far suggests the bull market may be far from over. Silver’s current momentum is underpinned by structural demand growth, particularly from industrial uses from solar photovoltaics to electric vehicles (“EV”), electronics and data centres. Investment demand for silver has also buoyed prices in 2025, with investors increasingly allocating to physical silver bullion, alongside physical gold, amid macroeconomic uncertainty and expectations of interest rate cuts. The silver market remained in structural deficit for the fifth consecutive year in 2025, leading to localised shortages and premiums for physical delivery during the year. On the supply side, mine output remains constrained, as a significant portion of global silver is produced as a byproduct of other base-metal mining, limiting the ability of producers to ramp up supply even as prices rise. Recycling has partially increased but is insufficient to offset structural deficits.

Figure 6

Source: Silver Institute, Metals Focus (2018 – 2025f), WPIC research, Bloomberg. Data at 31 December 2025.

PGMs face a similar market environment to silver, with platinum posting strong price gains in 2025 as prices hit multi-year highs. Industrial demand for platinum has been robust, buoyed by its essential application in catalytic converters and renewed Chinese consumption. Strategic stockpiling and recognition of platinum as a critical material have further supported investor interest. Production remains regionally concentrated, notably in South Africa, and operational disruptions and challenges have tightened availability. As a result, platinum’s structural deficit is persisting, supporting prices even as EV market share grows.

Looking ahead, both silver and PGM miners appear well positioned to operate in a supportive environment, underpinned by continued strength in industrial and investment demand, alongside persistent supply constraints. A key challenge for investors is likely to be ongoing price volatility, particularly in silver, which experienced sharp price movements toward the end of 2025 as speculative positioning and subsequent profit-taking drove significant short-term swings. Investors in silver mining equities will therefore need to actively manage this volatility, focusing on producers best positioned to benefit from a sector re-rating as silver prices move into a higher trading range.

Speciality and industrial metals – Miners face a geopolitical scramble for supplies

- Structural demand trends – The metals-intensive technologies of the new industrial revolution are driving a demand boom for critical metals and minerals.

- Strategic interests are focused on supply chains – Government support and investment in critical metals supply chain security is a positive driver for miners.

- Miners remain undervalued with strong financials – Undervaluation persists across many sub-sectors of the mining sector, on a relative and historic basis.

As mentioned at the start of this report, the mining sector sits at the centre of three major global investment themes in 2026. First, demand for critical metals is expected to accelerate rapidly as the technologies associated with the New Industrial Revolution such as AI, electrification, clean energy, and energy storage expand. Second, geopolitics and industrial policy, from Western efforts to reshore supply chains to China’s high-tech industrial strategy, are increasingly driving investment across the mining sector. Third, macroeconomic forces, including persistent inflation, subdued growth, and fiscal dominance, continue to strengthen the investment case not just for precious metals, but for a broader range of real assets.

Tailwinds for the metals and mining sector in 2026 are exacerbated by years of underinvestment in supply growth across many sub-sectors, such as copper, that face significant demand growth from AI, renewables and other technologies. Meanwhile others, including lithium, have seen a surplus of supply weigh on prices in recent years, yet face a potential turnaround in the months and years ahead due to strong demand. A major change for the mining sector has been the rising influence of strategic interests and geopolitics, which are playing an increasingly decisive role in metals markets, reshaping supply chains. Over the past year, major economies have updated or expanded their critical minerals lists and related strategies to better secure supply chains for clean energy, technology and defence. In November 2025 the US added copper, silver, potash and uranium to its List of Critical Minerals[i], while Australia is prioritising elements such as antimony, gallium and REE[ii]. In Europe and the UK, policymakers are likewise updating their lists to reflect supply-chain vulnerabilities[iii].

Undervaluation persists across the mining sector, on a relative and historic basis, and we believe mining equities are heavily under-owned. Miners currently trade on just a 7x EV/EBITDA multiple, significantly below broader equity markets[iv]. Meanwhile investor allocations to the mining sector remain low, with miners accounting for just 1% of global listed equities[v]. These factors, coupled with the strong demand forecasts for many metals, leads us to believe we are in the early stages of a cyclical upswing. We see a range of opportunities across speciality metals miners as rising demand for metals and improving investor sentiment drive a re-rating of this undervalued sector.

Figure 7

Source: Bloomberg, IEA, Baker Steel Capital Managers LLP, CRU, Benchmark Minerals Intelligence, Wood Mackenzie. Data at 31 December 2025.

2025 highlighted the effectiveness of Baker Steel’s Electrum strategy, which actively allocates across industrial, speciality, and precious metals miners. The strength of this approach lies in the diverse range of drivers and challenges facing the mining sector. The following section looks at some of the key metals for the Electrum strategy; industrial metals, notably copper and aluminium, then battery and energy transition metals, including lithium, REE and uranium.

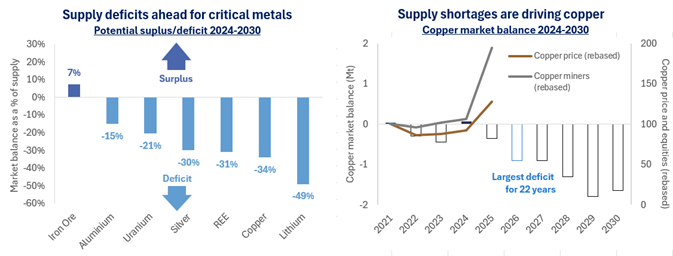

Industrial metals – Copper and other metals face looming deficits and supply challenges

Copper enters 2026 with a supportive backdrop, despite elevated geopolitical tensions. We expect the metal to lead the broader base metals complex higher in the months ahead, following one of the strongest annual performances for copper in over a decade in 2025. Prices exceeded USD 12k per tonne in late-2025, moving higher despite headwinds including Trump’s tariffs and weakness in China’s property sector, and have continued to make strong gains in early 2026.

Supportive fundamentals for copper are driven by structurally strong demand from the energy transition, transport electrification, smart grid investment, and the rollout of AI-related data infrastructure. Copper intensity of use across these technologies is high. A single EV uses around four times more copper than a conventional internal combustion engine vehicle, c.155 pounds in total, largely in wiring and battery systems[i]. As EV adoption accelerates, particularly in heavier SUVs and trucks, copper intensity is likely to continue rising. AI is another increasingly important demand driver for copper. AI data centres use roughly double the copper of conventional data centres, requiring 27–33 tonnes of copper per megawatt[ii]. It is estimated that copper usage in data centres globally will increase “sixfold by 2050”[iii].

Against this strong demand outlook, the copper sector faces its largest supply deficit for 22 years in 2026[iv]. This deficit is set to expand as copper supply is constrained by declining ore grades, long lead times for new mines, limited new project pipelines, rising costs and persistent operational disruptions. Lead times for new mines have grown to over 15 years from discovery to production. Supply tightness can also be seen in copper smelting, refining and treatment charges at historic lows. Current treatment charges are in negative territory, around -USD 45/t[v]. This is significantly below typical levels of above USD 50/t in balanced markets, reflecting the squeeze in concentrate supply.

Supply disruptions have weighed on the copper market in recent years. 2025 saw major disruption at the Kamoa-Kakula mine in the Democratic Republic of Congo, and the El Teniente mine in Chile, two of the world’s largest copper mines, as a result of seismic activity[vi]. In addition, the Grasberg mine in Indonesia, another globally significant copper mine, declared force majeure and halted operations following a mud rush incident[vii]. The impact of these supply disruptions persists, with recovery at some operations taking longer than expected. Looking ahead, copper’s vulnerability to supply shocks reinforces our constructive outlook for copper prices.

Figure 8

Source: IEA, Baker Steel Capital Managers LLP, CRU, Benchmark Minerals Intelligence, Wood Mackenzie, Morgan Stanley, Bloomberg.

Against this backdrop, the investment case for copper miners is clear. As active investment managers we seek value and aim to remain nimble in a sector where operational disruption and geopolitics can have a significant impact. While price volatility is likely to persist, we consider that the copper market’s looming deficit supports higher copper prices and positive sentiment from investors towards copper miners. Looking to 2026 we believe M&A will continue to be an important theme, as producers seek to increase their reserves and lower costs. In 2025 the race for copper drove the largest mining deal of the year, the proposed USD 50bn merger of Anglo American and Teck Resources[i]. Given the challenges in developing new mines, we consider this trend will continue as miners prefer to buy rather than build.

Alongside copper, a range of industrial metals, including tin and aluminium, face a strong outlook in the months ahead. Notably, the aluminium sector has shown resilience, rising through 2025 despite broader commodity headwinds, supported by tight supply conditions and steady demand from construction, transport and energy-transition sectors. Supportive government policies and carbon regulations, notably the Carbon Border Adjustment Mechanism (“CBAM”), offer further drivers. Aluminium also benefits from strength in copper, as substitution supports prices. On the supply side, growth remains constrained by logistical challenges, limited low-carbon smelting capacity and a tight scrap market. Crucially, aluminium is an energy-intensive metal, and access to reliable, low-cost, renewable power is becoming the main bottleneck to new supply. For 2026, we favour aluminium miners with integrated refining assets, secure green power access and exposure to emerging “green aluminium” premia, as structural tightness underpins an attractive medium-term outlook.

Looking more broadly across the industrial metals complex, we believe the opportunities, risks and themes for 2026 favour active management. Industrial metals markets face significant volatility and uncertainty in 2026, amid ongoing fallout from Trump’s tariffs, US-China tension over supply chains and more broadly the growing impact of strategic competition for raw materials. We consider this is a highly conducive environment for Baker Steel’s active strategies. M&A among the diversified majors is likely to be a key theme in the months ahead. Anglo American and Teck Resources announced a USD 53 billion merger of equals in September 2025, creating a new entity named Anglo Teck, positioning it as one of the world’s top copper producers[ii]. Separately, Rio Tinto and Glencore have restarted merger talks that could potentially create the largest mining company globally if completed[iii]. These deals, whether or not they go through, highlight the need for production growth particularly in the copper industry and signal that the focus on M&A among the majors is unlikely to go away.

Battery and energy transition metals – Strategic support amid rising demand for energy and energy storage solutions

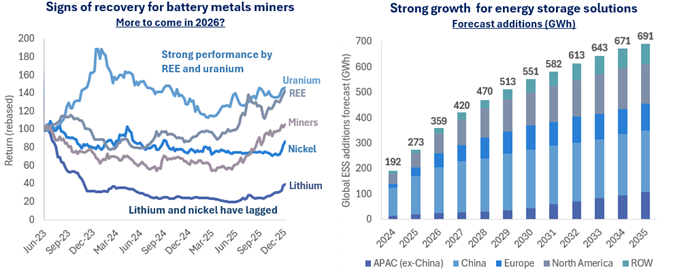

Amid a renewed focus by governments and businesses on securing supply chains for critical metals and minerals, producers of these raw materials are once again attracting attention. In this section, we consider several of the critical metals central to Baker Steel’s Electrum Strategy: lithium, REE, and uranium. These metals sit at the heart of the global push toward electrification, energy security, and advanced technologies, while also representing key vulnerabilities within critical metals supply chains. In recent years, a divergence in price performance has emerged across these commodities as demand and supply dynamics have evolved rapidly. Uranium and REE miners delivered strong performance in 2025, while lithium miners showed tentative signs of recovery.

Starting with lithium, we consider that this sector presents a compelling opportunity for further recovery in 2026. The metal is critical to electrification, with demand forecast to grow by nearly 150% by 2030[iv]. The case for lithium has been linked closely to EV market growth in recent years, yet it is increasingly clear that the expansion of grid-scale energy storage systems presents another substantial demand driver which could result in a sooner than anticipated recovery. The weak performance of the lithium price in recent years has been largely due to aggressive supply growth, which pushed the market into surplus, leading to a sharp price correction from its 2022 highs. This surplus appears cyclical rather than structural, with early signs of recovery emerging as producers curtail output and demand from energy storage strengthens. Strategic production cuts by major suppliers and the prospect of a future restocking cycle suggest the market could tighten again later this decade.

Figure 9

Source: Argus Consulting, Bloomberg. Data at 14 January 2026.

Turning to REEs, these metals are uniquely strategic due to their role in permanent magnets used across EVs, wind power, defence systems, and high-performance electronics. Magnet metals such as neodymium and praseodymium are already in supply deficit, with the shortfall projected to widen to around 22% of supply by 2030[i] as demand accelerates. Heavy REEs, including dysprosium and terbium, are expected to remain structurally tight. EVs currently account for roughly one-third of magnet REE demand and are forecast to approach 60% by 2035[ii], while wind turbines, consumer electronics, and AI data centres add further secular demand. Supply-chain concentration remains acute, with China controlling the majority of mined output, processing capacity, and magnet manufacturing. In response, Western governments have become increasingly active, highlighted by the US Department of Defense’s USD 550m partnership with MP Materials in 2025[iii], including a price floor well above spot levels. These initiatives signal a shift away from persistently low REE pricing and provide long-term support for non-Chinese supply chains, even as China’s dominance remains difficult to dislodge.

Finally, uranium has also re-emerged as a strategic priority amid a global reassessment of nuclear energy’s role in decarbonisation and energy security. Uranium demand is forecast to rise nearly 51% by 2030[iv] as reactor lifetimes are extended, idle capacity is restarted, and new large-scale and small modular reactors are developed, particularly in China, the US, and parts of Europe. After more than a decade of underinvestment, supply remains constrained, with the market reliant on finite secondary sources to cover a persistent deficit. Policy support has strengthened meaningfully, especially in the US, where recent initiatives include financing support for new reactors and ambitious capacity targets. At the same time, technology companies are increasingly funding nuclear projects to secure reliable power for AI-driven data centres, reinforcing uranium’s improving demand outlook.

For more detail on the strategic support and investment in the critical metals sector, please read the recent report for Baker Steel’s team: Strategic competition for critical metals – What does it mean for miners?

Conclusion – Will the metals and mining sector be in the spotlight in 2026?

We believe the mining sector in 2026 is undoubtedly a stock pickers’ market. Beta will continue to deliver returns as commodity prices rise, but the potential for alpha generation is high. In this report, we have focused on some of the key metals which the Baker Steel strategies have held meaningful exposure to over the past year. As a leading natural-resources fund manager, Baker Steel’s focus on value, margins, quality, and ESG offers investors enhanced upside potential, with a particular advantage under current volatile market conditions. Our investment process combines bottom-up equity analysis, assessing asset quality, operational performance, and risk exposure, with top-down insights into commodity trends, geopolitical developments, and structural demand drivers.

The opportunity set is broad in 2026. On precious metals miners, rising profitability, strong margins and capital discipline, positions this sector for a constructive 2026. We consider that investor sentiment towards precious metals miners will continue to improve, as the investment case for gold and silver strengthens. Fiscal dominance and persistent inflation are driving demand for gold for wealth protection, while trade confrontation, de-dollarisation and geopolitical tension continue to strengthen the appeal of gold as a reserve asset for central banks globally. Regarding industrial and speciality metals miners, the growing appreciation of the strategic value of critical raw materials is likely to keep the mining sector in the spotlight in 2026. Substantial demand forecasts and tight supply indicate shortages and market deficits ahead. Miners themselves are maintaining discipline, while the potential for M&A is significant.

The metal and mining sector faces a transformative period ahead, as technological development drives demand, supply challenges persist, and macroeconomic factors impact commodity prices. At Baker Steel we focus our exposure on those sub-sectors of the mining industry best positioned for outperformance, both tactically in the short-term and through exposure to longer-term themes. We see a potent combination of metals-intensive innovation, pro-growth industrial policy, and structurally tight raw-material supply chains which provides a compelling backdrop for strong performance by the mining sector in the year ahead.

[i] Bloomberg, data in USD terms.

[ii] Bloomberg, data at 31/12/25.

[iii] World Gold Council, October 2025.

[iv] Scotiabank.

[v] Goldman Sachs.

[vi] Phemex.

[vii] Baker Steel Capital Managers LLP, company reports.

[viii] Scotiabank.

[ix] Scotiabank.

[x] Bloomberg, MSCI, data at 31/12/25.

[xi] Scotiabank.

[xii] Barrons.

[xiii] USGS.

[xiv] Reuters.

[xv] IEA.

[xvi] Bloomberg, data at 31 December 2025.

[xvii] Statista, S&P Global Market Intelligence, Crescat Capital.

[xviii] Copper Alliance.

[xix] Grupo México, FT.

[xx] BHP.

[xxi] Morgan Stanley.

[xxii] Discovery Alert.

[xxiii] Ivanhoe, Codelco.

[xxiv] Freeport McMoran.

[xxv] FT.

[xxvi] S&P Global.

[xxvii] FT.

[xxviii] Scotia, 2024-2030 forecast.

[xxix] Canaccord.

[xxx] Canaccord.

[xxxi] MP Materials.

[xxxii] TD Cowen, 2024-2030 forecast Baker Steel Capital Managers LLP.

About Baker Steel Capital Managers LLP

About Baker Steel Capital Managers LLP

Baker Steel Capital Managers LLP manages three award winning investment strategies, covering precious metals equities, speciality metals equities and diversified mining.

Baker Steel has a strong track record of outperformance relative to its peers and relative to passive investments in the metals and mining sector. BAKERSTEEL Precious Metals Fund is the 2025 winner of the GELD-Magazin Alternative Investment Award, and 2025 winner for the seventh year running of the Lipper Fund Awards while BAKERSTEEL Electrum Fund is the 2025 winner of the Euro Fund Awards Commodity Equities Performance over 10 years. The Baker Steel Resources Trust has also been named Investment Company of the Year 2021, 2020, 2019, Natural Resources, by Investment Week.

Fund Managers Mark Burridge and David Baker have been awarded two Sauren Gold Medals for 2021 and were awarded Fund Manager of the Year at the 2019 Mines & Money Awards.

Important

Please Note: This document is a financial promotion is issued by Baker Steel Capital Managers LLP (a limited liability partnership registered in England, No. OC301191 and authorised and regulated by the Financial Conduct Authority) for the information of a limited number of institutional investors (as defined in the Fund prospectus) on a confidential basis solely for the use of the person to whom it has been addressed. This document does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe or purchase any shares or any other interests nor shall it or the fact of its distribution form the basis of, or be relied on in connection with, any contract therefor. Recipients of this document who intend to apply for shares or interests in Baker Steel’s funds are reminded that any such application may be made solely on the basis of the information and opinions contained in the relevant prospectus or other offering document relating thereto, which may be different from the information and opinions contained in this document. This report may not be reproduced or provided to any other person and any other person should not rely upon the contents. The distribution of this information does not constitute or form part of any offer to participate in any investment. This report does not purport to give investment advice in any way. Past performance should not be relied upon as an indication of future performance. Future performance may be materially worse than past performance and may cause substantial or total loss.